The Homebuyer's Guide to Navigating the Fluctuating Interest Rates

Discover how to navigate the ups and downs of interest rates to secure the best mortgage deal for your new home.

Navigating the Fluctuating Interest Rates: Your Homebuyer's Guide

Welcome to our mortgage blog, where we delve into the intricate world of real estate finance. If you're considering purchasing a new home or refinancing your existing mortgage, you've likely come across the term "fluctuating interest rates." In today's ever-changing market, understanding how these fluctuations can impact your home buying journey is crucial. Don't worry, though - we've got you covered with this comprehensive guide to help you navigate the ups and downs of interest rates.

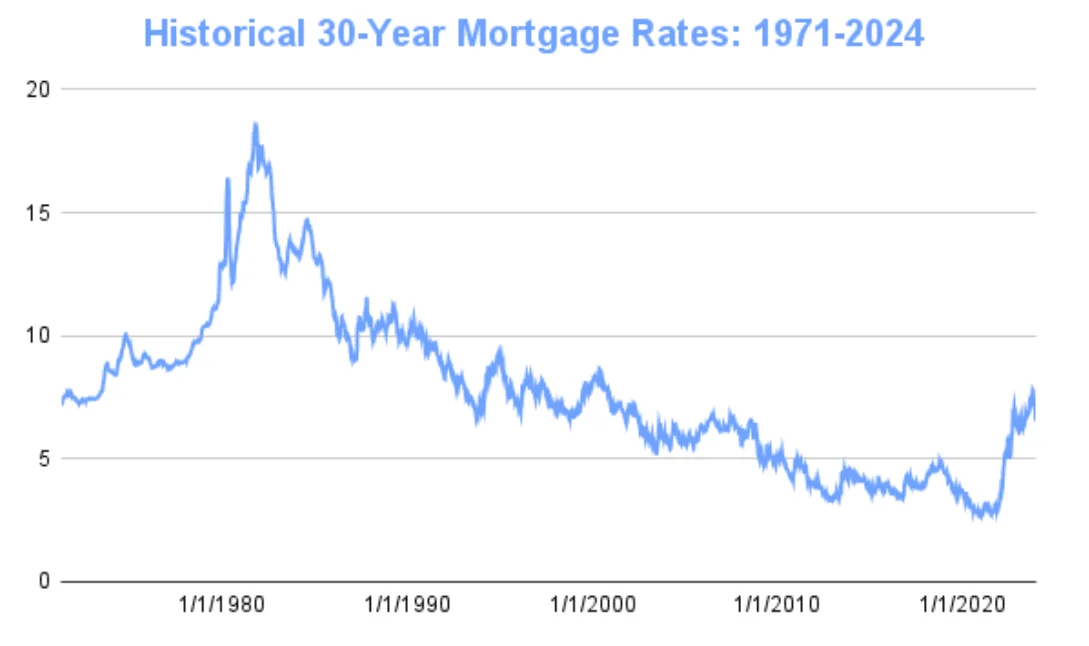

So, what are fluctuating interest rates, and why should you care? Simply put, interest rates for mortgages can vary over time due to a multitude of factors such as changes in the economy, inflation, and the overall health of the housing market. These fluctuations can have a significant impact on the affordability of your home loan. Understanding how these changes affect your finances is key to making informed decisions about your home purchase.

As a prospective homebuyer, it's essential to stay informed about the current state of interest rates. Keep an eye on financial news, consult with reputable mortgage experts, and consider the long-term implications of your mortgage. Navigating fluctuating interest rates requires a proactive approach and a willingness to adapt to market conditions.

Here are some key strategies to help you navigate fluctuating interest rates and make the most of your home buying experience:

1. Educate Yourself: Take the time to research and understand how interest rates work. Familiarize yourself with terms such as fixed-rate mortgages, adjustable-rate mortgages, and the factors that influence interest rate movements. The more you know, the more confident you'll be in making informed decisions.

2. Assess Your Financial Situation: Before diving into the home buying process, evaluate your financial standing. Determine your budget, assess your credit score, and gather essential financial documents. Knowing where you stand financially will help you determine the type of mortgage that best suits your needs.

3. Seek Professional Guidance: Working with a competent and knowledgeable mortgage loan officer is invaluable. An experienced professional can provide personalized guidance, explain the nuances of interest rate fluctuations, and help you identify the best mortgage options tailored to your specific needs.

4. Consider Your Long-Term Goals: When evaluating mortgage options, consider your long-term financial goals. Are you planning to stay in your new home for the long haul, or is it a short-term investment? Your loan officer can help you align your mortgage strategy with your future plans.

5. Stay Proactive: In a market with fluctuating interest rates, staying proactive is key. Keep an open line of communication with your loan officer, monitor market trends, and be prepared to act when the time is right. Being proactive can help you take advantage of favorable rate fluctuations.

Remember, the key to successfully navigating fluctuating interest rates is to remain adaptable and open to the guidance of mortgage professionals. Your dream of homeownership is within reach, and with the right support and knowledge, you can confidently navigate the ever-changing landscape of interest rates.

Are you ready to take the next step towards homeownership? We invite you to reach out to one of our knowledgeable mortgage loan officers to discuss your specific needs. Our team is dedicated to providing personalized guidance and tailored solutions to help you achieve your homeownership goals. Get in touch with us today and let's embark on this exciting journey together!